Self-Exclusion Programs Explained: How They Work and What to Expect

Self-exclusion blocks your access to gambling products for a set time. You choose it when you need a hard stop. It can cover one casino, one operator, or an entire state or national scheme, depending on where you live.

This guide explains how self-exclusion programs work, what you must do to enroll, and what happens after you sign up. You will learn the typical time options, where the bans apply, how enforcement works online and in person, and what removal or reinstatement rules look like. You will also see limits, including what self-exclusion does not stop, like offshore sites, cash play, or gambling-related ads.

If you also want day-to-day controls, see responsible gambling limits and tools. If you need help beyond blocking access, read warning signs and where to get help.

What are self-exclusion programs explained?

Definition

Self-exclusion is a voluntary agreement you make with a gambling operator or a regulator. You ask them to block your access to gambling products or venues for a set period.

You choose the scope. It can cover one site, one casino, a group of brands, or a whole state or national program, depending on where you live.

Core goal

Self-exclusion creates time and space between you and gambling. The aim is simple, reduce harm and help you regain control.

It works best when you pair it with day-to-day controls and support. See Responsible Gambling Tips: Limits, Tools, and Safer Play and Signs of Gambling Addiction: Warning Signs and Where to Get Help.

Common settings

Programs vary by jurisdiction and operator. Most cover one or more of these areas.

- Casinos and gaming floors: you get barred from entry or removed if you enter.

- Online casinos: your account gets blocked, login and play stop.

- Sportsbooks: wagering stops across web, app, and retail locations included in the program.

- Poker rooms: you cannot register, buy in, or earn comps tied to your account.

- Lotteries: some areas support exclusion from online lottery accounts, fewer can block in-store ticket sales.

Coverage can differ across brands, kiosks, and partner venues. Always check what the program includes before you enroll.

Self-exclusion vs. other tools

Self-exclusion is the strongest access block you can request. Other tools help, but they do less.

| Tool | What it does | Best use |

|---|---|---|

| Self-exclusion | Blocks access for a fixed term. You often cannot reverse it early. | When you need a hard stop and time away. |

| Cooling-off | Short break set by the operator or by you, often days. | When you feel risk rising and want a quick reset. |

| Timeout | Very short lock, often hours to a few days. | When you need an immediate pause during a session. |

| Deposit limits | Caps what you can add to your account. It does not stop play if funds remain. | When overspending is the main issue. |

| Account closure | Closes your account, but reopening rules can be easier than exclusion. | When you want to stop using one operator. |

How self-exclusion programs work (step-by-step)

Enrollment pathways, operator program vs. registry

You can self-exclude through one operator or through a shared registry.

- Operator-based exclusion. You request exclusion with a specific sportsbook, casino site, or land venue. It blocks you only with that operator and its brands it controls.

- State, provincial, or national registry. You enroll once and the ban applies across many licensed operators in that jurisdiction. Coverage varies by region and license type.

If you use more than one site, a registry usually gives broader protection. If your issue sits with one operator, a direct request can be faster.

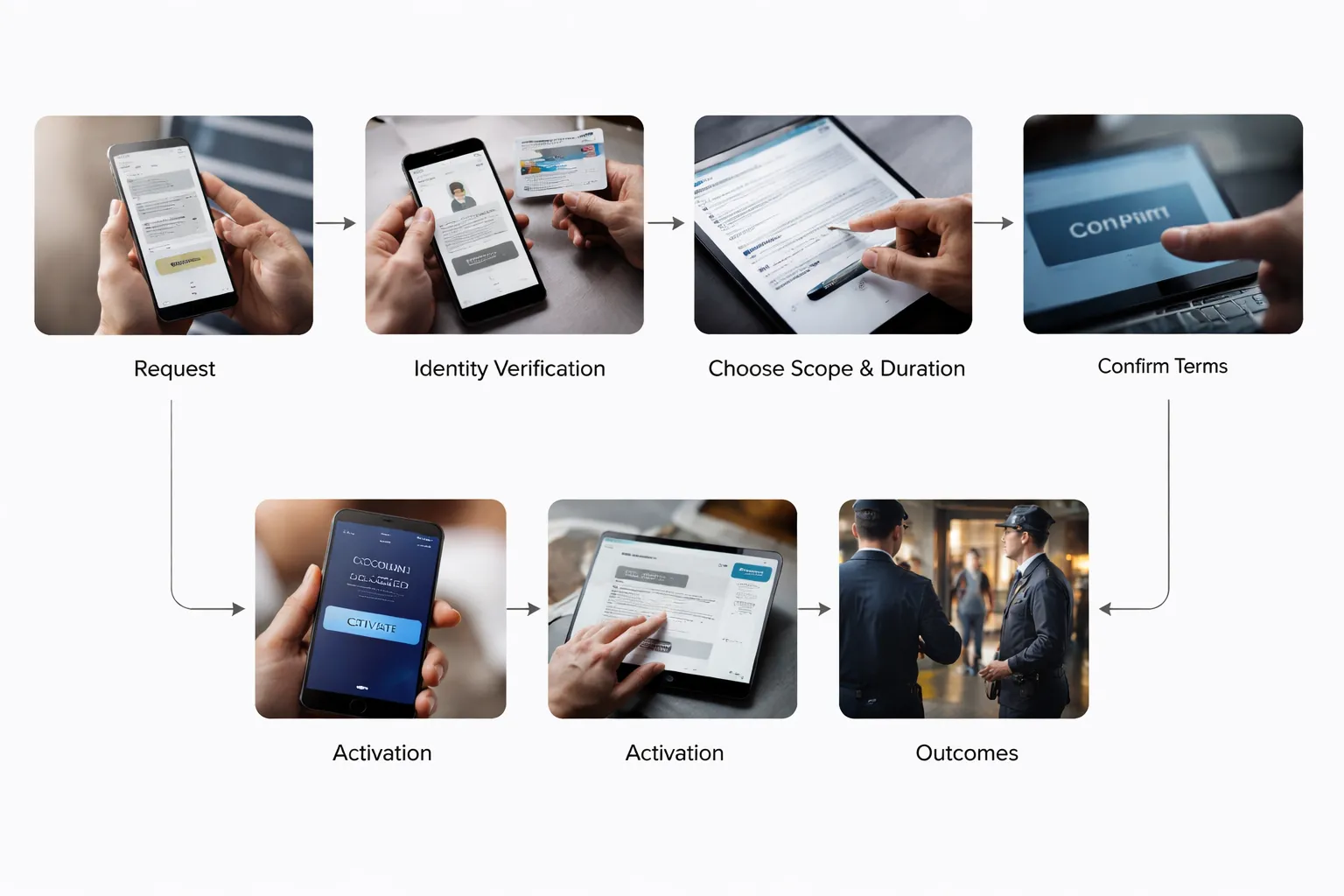

Typical steps, from request to activation

- 1) Submit a request. You apply online, in an app, by phone, by email, or in person. Some jurisdictions require in person signup for land venues.

- 2) Verify your identity. You provide legal name, date of birth, address, and government ID details. Some programs ask for a photo or a live selfie check.

- 3) Choose scope. You select channels such as online betting, casino games, poker, retail sportsbook, or physical casinos. Scope depends on the program rules.

- 4) Choose duration. Common terms include 6 months, 1 year, 2 years, 5 years, or lifetime. Some programs set minimum terms and do not allow early removal.

- 5) Confirm the terms. You accept conditions such as no access, limited support for recovery, and what happens if you attempt to gamble during the ban.

- 6) Activation. The operator or registry applies the block and records your exclusion.

If you want smaller guardrails instead, use limits first. See Responsible Gambling Tips: Limits, Tools, and Safer Play and How to Set a Gambling Budget (and Stick to It).

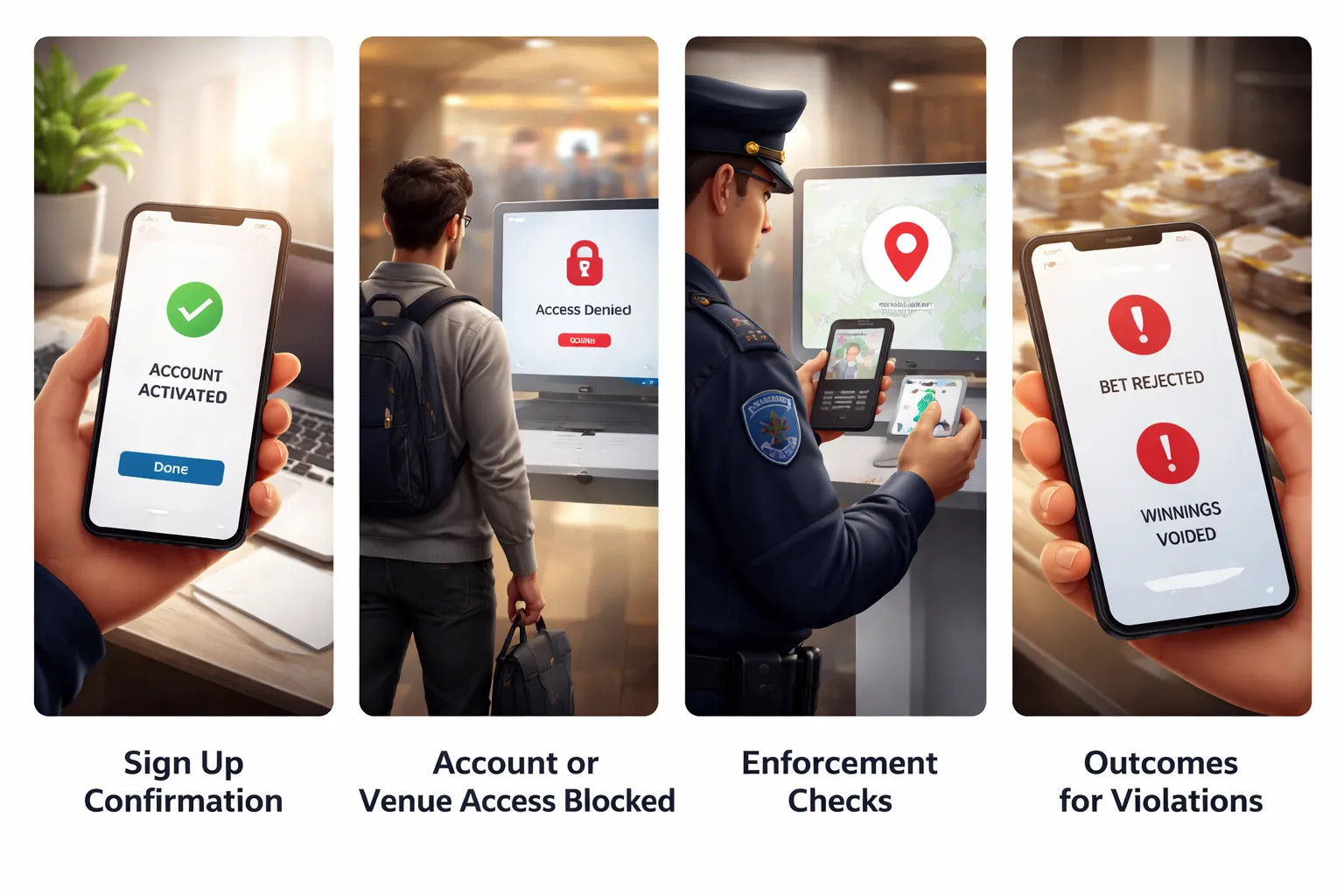

What happens after activation

- Account restrictions. You cannot log in, place bets, or deposit. If you can still log in, you should see a lock message and no betting functions.

- Marketing suppression. The operator should stop sending promos, bonus offers, and push alerts tied to gambling. Some messages may still arrive for service or legal reasons.

- Payments and withdrawals. You usually can withdraw remaining funds, but you cannot add funds or wager. Processing rules vary by operator and jurisdiction.

- Venue access controls. For land casinos, staff may deny entry, remove you from the floor, or trespass you. Some programs use ID checks at entry, player card flags, or photo lists for security teams.

- Support prompts. Many programs display help links and crisis resources during the blocked period. If you need a deeper check, use Signs of Gambling Addiction: Warning Signs and Where to Get Help.

What information gets collected and shared

Programs collect enough data to identify you and enforce the ban.

- Identity data. Full legal name, date of birth, address, and partial or full government ID numbers.

- Contact data. Email, phone, and contact preferences for non marketing notices.

- Account data. Username, customer ID, linked payment markers, and device or security notes where allowed.

- Photo data. A headshot or selfie, more common for land based exclusions and some registry systems.

Operator programs usually keep data in house. Registry programs may share your data with all participating licensed operators and relevant regulators. They use it to match you and block access.

When it takes effect and how long it lasts

| Program type | When it usually takes effect | How long it lasts |

|---|---|---|

| Operator-based | Often same day, sometimes immediate after verification. | Fixed term you choose, subject to minimums. Early removal often blocked. |

| Registry-based | Can be same day or after a processing window for matching and distribution. | Fixed term set by the registry options. Reversal rules are strict, sometimes lifetime. |

Expect delays when the program needs manual review, in person identity checks, or distribution to multiple operators. Keep copies of confirmation emails or reference numbers.

What to expect during self-exclusion (benefits, limitations, and real-world scenarios)

Benefits you can expect

- Reduced access. You lose access to your account or venue entry for the term you chose.

- Fewer triggers. You stop seeing your balance, bet history, and in-session prompts that pull you back in.

- Fewer promotions. Many programs stop marketing emails, texts, and app notifications tied to the excluded brand.

- A structured commitment. You set a clear start date and end date, or lifetime, with written confirmation. That record helps you stick to your plan.

Self-exclusion works best when you combine it with other tools, like deposit limits and a written budget. See How to Set a Gambling Budget (and Stick to It) and Responsible Gambling Tips: Limits, Tools, and Safer Play.

Limitations you should plan for

- It may not block unregulated or offshore sites. Those operators can ignore your exclusion.

- Coverage can vary by product. Some programs cover sports betting but not casino, poker, or lottery, or the reverse.

- Coverage can vary by location. A state or national registry may not cover tribal properties, independent venues, or another jurisdiction.

- It does not remove gambling content from the internet. You may still see ads, affiliates, and social media content unless you block them yourself.

- Customer support cannot override it. Reinstatement rules stay strict. Some programs lock you out until the term ends, with a cooling-off window.

What happens in real life

- You try to log in. The site blocks access. You may see a notice that your account is self-excluded. Password resets will not help.

- You try to deposit. The cashier blocks the payment flow. Some operators also block saved cards and linked wallets for that account.

- You try to place a bet. The bet slip fails, or the system blocks you before submission.

- You try to create a new account. A strong program matches identity data, then blocks the new registration. Weak matching can miss you if your details change.

- You try to enter a venue. Security or the front desk may check your ID. If they find you on the list, they refuse entry and document the attempt.

How enforcement usually works

- Account blocking. Operators flag your profile and disable gambling features, deposits, and play.

- Identity matching. Systems compare name, date of birth, address, email, phone, and ID records. Manual review can add delays.

- Geolocation checks. For online betting, location tools still run. If your account is excluded, location approval will not restore access.

- ID checks at entry. Many venues rely on scanned IDs. Some also use facial recognition where allowed.

- Staff protocols. Staff may escort you out, record the incident, and notify management. The response depends on venue policy and local law.

If you try to violate the exclusion

You will usually see one of these outcomes. Rules vary by operator and jurisdiction, so read the program terms.

- Attempt logged. The operator records the date, method, and staff actions.

- Bets rejected or voided. Many operators void wagers placed during exclusion. Some return stakes. Some hold funds until review.

- Winnings withheld. Some programs allow confiscation of winnings from gambling during exclusion. Others void only the bet. Local rules control this.

- Venue trespass risk. Entering after exclusion can trigger removal and a formal trespass notice. Repeat incidents can lead to penalties.

If you keep trying to bypass blocks, treat it as a warning sign. Use Signs of Gambling Addiction: Warning Signs and Where to Get Help.

Bonuses, loyalty points, comps, and VIP status

- Bonuses stop. You should not receive new offers during exclusion. Bonus balances may expire or get removed.

- Loyalty points freeze or reset. Many programs pause earning and may forfeit unused points, tiers, and benefits.

- Comps and host access end. Casino comps, free play, and VIP services usually stop. Hosts often must stop outreach.

- Marketing lists should update. Expect fewer emails and texts, but keep an eye out for mistakes. Save proof of your exclusion and report continued contact.

Types of self-exclusion programs and how to choose the right one

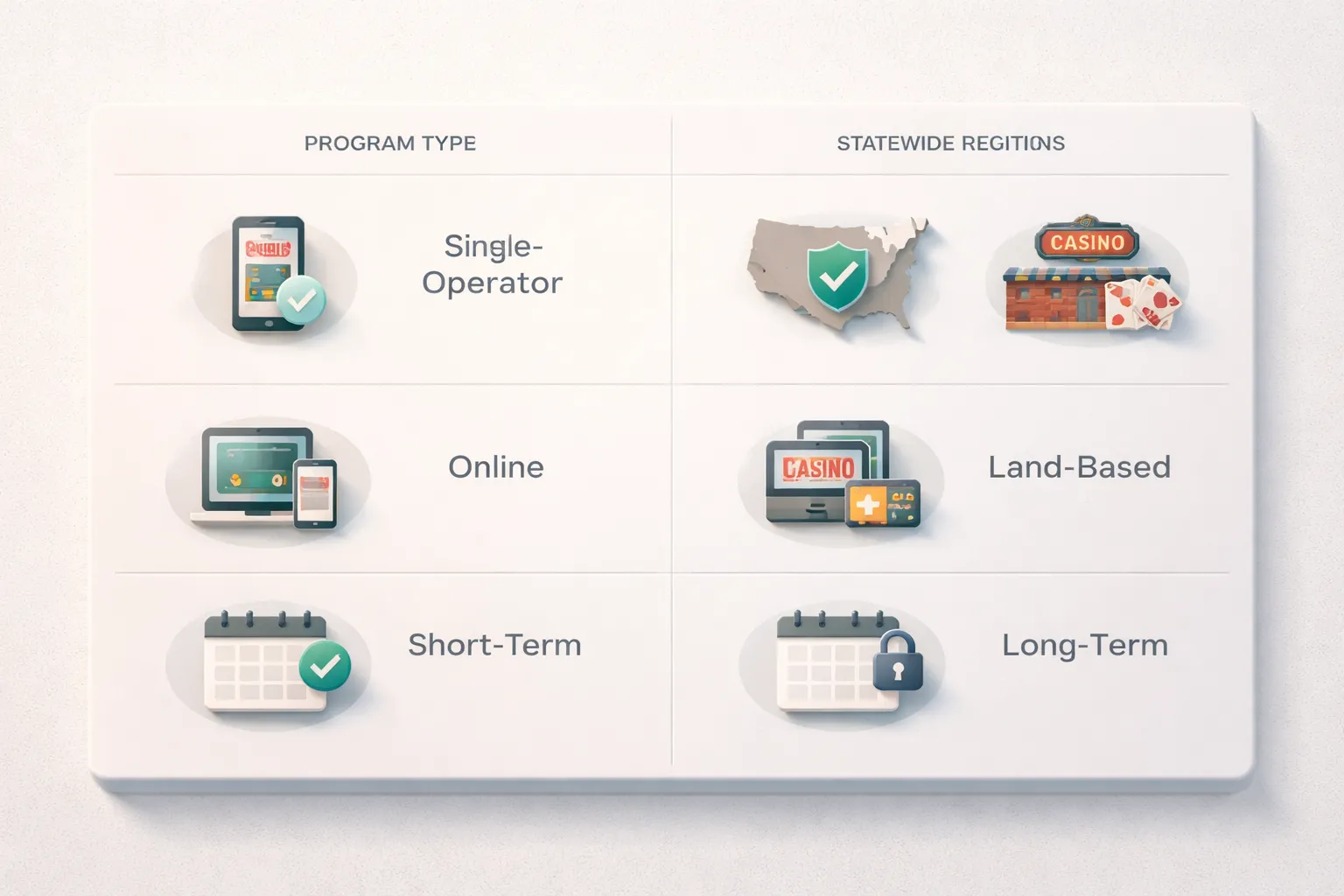

Types of self-exclusion programs

Programs differ by who runs them, where they apply, and what they block. Your goal is simple, reduce access across your real gambling paths.

Single-operator exclusion vs. multi-operator registries

- Single-operator exclusion, blocks you from one brand or one venue group. Use it when you gamble with a specific operator, or when no registry exists where you live.

- Multi-operator or statewide registries, block you across many licensed operators in a state or territory. Some cover both online and retail locations. These programs usually give you the broadest coverage for one enrollment.

- Tribal and local programs, may run outside state systems. Coverage varies by compact and property. You may need to enroll with each entity.

Online vs. land-based coverage, and where they overlap

- Online self-exclusion, blocks your account access on app and web. It can stop deposits, betting, and logins. It may not stop you from creating an account at a different brand unless you use a registry.

- Land-based self-exclusion, targets physical entry and on-site gambling. Enforcement often relies on ID checks, staff recognition, and surveillance. You can still get triggered by being on property, even if you cannot gamble.

- Overlap depends on the program. Some state lists feed both online operators and casinos. Others split the systems. Read the coverage statement line by line.

Duration options

Duration choices depend on your jurisdiction and operator. Many programs offer fixed terms such as 6 months, 1 year, 3 years, or 5 years. Some offer permanent exclusion.

- Short-term, gives fast relief. It also ends sooner, which raises relapse risk if triggers stay the same.

- Multi-year, fits repeated slip-ups, high spend, or strong cravings. It reduces the chance you wait out the clock.

- Permanent, fits severe harm, loss of control, or repeated breaches. Some places allow removal after a long minimum term and a formal process. Others treat it as final.

Scope decisions, products and channels

Pick the widest scope you can tolerate. Narrow choices create easy workarounds.

- Products, casino games, sportsbook, poker, bingo, lottery, or racing. Some programs let you exclude from one product only. Others lock all regulated gambling under one ban.

- Channels, app, web, phone, kiosk, and in-person. Make sure the program blocks every channel you use.

- Payments and promos, check whether deposits, withdrawals, and marketing get blocked. Marketing mistakes happen, keep records and report them.

How to avoid gaps

- Start with a registry if you have one. It usually covers more operators with one signup.

- Enroll directly with your top operators too, even if you join a registry. Data feeds can lag. A direct exclusion closes the gap.

- Cover adjacent products. If you binge on slots, block sportsbook too if you use it as a substitute, or if it keeps you in the same app.

- Close access points you use most. Delete apps. Block sites on your devices. Remove saved payment methods. Add bank blocks if available.

- Track confirmations. Save emails, screenshots, and reference numbers. You need proof if access stays open.

How to choose the right program

Choose based on risk level, access points, and triggers. Match the program to how you actually gamble.

- If you chase losses or feel out of control, pick the longest term available and the broadest scope. Permanent may fit if harm is severe.

- If you gamble across many brands, use a statewide or multi-operator registry first. Then add direct exclusions for any brand you used most.

- If your trigger is physical space, exclude from land-based venues, even if you mostly bet online. Do not rely on online-only blocks.

- If your trigger is your phone, prioritize online coverage and device blocks. Remove fast-deposit options and stored cards.

- If you need earlier warning signs, review your patterns and triggers, then set limits and safeguards that support the exclusion. See Signs of Gambling Addiction: Warning Signs and Where to Get Help and Responsible Gambling Tips: Limits, Tools, and Safer Play.

Rules, privacy, and compliance: what laws and policies typically cover

Self-exclusion runs on rules, not promises. Your coverage depends on your jurisdiction and the operator’s license. Most programs set fixed terms, require ID checks, and limit early removal. Many also require casinos and sportsbooks to train staff, stop marketing to you, and block your account access. Privacy rules control what data they collect, who they share it with, and how long they keep it. Compliance rules define audits, breach handling, and penalties when an operator lets you gamble while excluded. Expect gaps. One state or country does not always cover another. One brand does not always cover sister sites. Treat self-exclusion as one layer, then pair it with limits and tools from Responsible Gambling Tips: Limits, Tools, and Safer Play.

Read our detailed guide: Rules, privacy, and compliance: what laws and policies typically cover - Self-Exclusion Programs Explained: How They Work and What to Expect

After you self-exclude: support options, removal, and relapse prevention

What to do next: counseling, peer support, and financial safeguards

Self-exclusion stops access, it does not treat the habit. Add support now, while motivation is high.

- Counseling: Look for a licensed therapist with gambling experience. Ask about CBT, relapse prevention planning, and family sessions.

- Peer support: Try Gamblers Anonymous or local recovery groups. Use meetings to build routine and accountability.

- Medical support: If you have depression, anxiety, ADHD, or substance use, treat it. These issues raise relapse risk.

- Money safeguards: Hand over control of high risk funds. Use a trusted person for bill pay, remove saved cards, and reduce available credit.

If you see escalating urges, secrecy, or money chasing, read Signs of Gambling Addiction: Warning Signs and Where to Get Help.

Practical barriers: bank gambling blocks, blocking software, app limits, device controls

Add friction. Make gambling hard to start and easy to interrupt.

- Bank and card blocks: Ask your bank to block gambling merchant codes. Block cash advances. Lower ATM limits. Turn off international payments if you use offshore sites.

- Payment clean-up: Delete stored cards from gambling accounts, app stores, and browsers. Remove e-wallet links. Cancel accounts you do not need.

- Blocking software: Install gambling site and app blockers on every device you use. Lock settings with a password you do not control.

- Phone controls: Use Screen Time or Digital Wellbeing to block app installs, limit browsers, and restrict adult content and gambling keywords.

- Router controls: Use DNS filters and router level blocks for home Wi-Fi. Cover every device on your network.

- App store limits: Require approval for downloads. Disable in-app purchases where it affects your risk.

Pair these barriers with limits and safer play tools from Responsible Gambling Tips: Limits, Tools, and Safer Play.

How removal or reinstatement works, if allowed

Many programs treat self-exclusion as a binding agreement. Some allow removal after the term ends. Some allow early removal only after a formal process. Rules vary by regulator and operator.

| Step | What you can expect |

|---|---|

| Minimum term ends | You must complete the full period. Many programs do not allow early reversal. |

| Cooling-off period | Some systems add extra days or weeks after you request removal. The goal is to reduce impulse reinstatement. |

| Re-application | You often must submit a new request to lift the exclusion. It may not switch off automatically. |

| Identity checks | You may need ID, proof of address, and account details. Expect fraud checks and record matching. |

| Safer gambling review | Some operators ask for a conversation, written statement, or evidence of support steps before access returns. |

If you plan to return, set strict limits first. Put them in place before you regain access, not after.

Planning for high-risk moments: triggers, accountability, and alternative activities

Relapse often starts with a predictable pattern. Track it. Plan around it.

- Know your triggers: payday, loneliness, alcohol, sports events, boredom, conflict, late nights, and phone scrolling.

- Write an urge plan: a 10 minute delay rule, leave the room, call a support contact, and do one fixed task.

- Use accountability: share bank access with a trusted person, set spending alerts, and schedule weekly check-ins.

- Replace the routine: exercise, gaming without gambling mechanics, hobbies with hands-on focus, volunteering, and structured social plans.

- Control the environment: avoid gambling content on social media, mute sports betting ads, and remove tipster channels.

If you use budgets, keep them for daily spending only. Do not build a gambling budget. If you need a structure for money management, use How to Set a Gambling Budget (and Stick to It) as a boundary plan, then set the number to zero during exclusion.

If self-exclusion isn’t enough: escalate to broader protections and professional help

Self-exclusion can fail when you switch sites, use offshore operators, or gamble in venues outside the program. Escalate fast if you slip.

- Expand coverage: enroll in every state, national, and operator scheme you can access. Add venue bans where available.

- Block more channels: tighten bank blocks, add router filters, and lock device settings with third-party control.

- Reduce access to cash: lower daily withdrawal limits, close extra accounts, and remove overdraft and credit options.

- Get professional help: ask a clinician for a formal gambling disorder assessment and a treatment plan.

- Protect your household: set shared financial rules, add transparency on statements, and create a plan for bill priority.

Act early. Small slips turn into large losses when you delay support.

- In het kort: Self-exclusion blocks your access to gambling for a set period. It gives you time and space to stop.

- You choose the scope. One operator, one venue, or a national register.

- You choose the length. Short breaks help, longer terms reduce relapse risk.

- Expect friction. You may lose access to your account, promos, and some services fast.

- Enforcement varies. Online checks can work well, in-person venues depend on ID checks and staff action.

- It does not block everything. You can still find unlicensed sites, cash games, or new payment routes.

- Use backups. Set deposit limits, lower withdrawal limits, block gambling payments, and remove credit options.

- Add support. Pair self-exclusion with treatment, and review the signs of gambling addiction.

- Plan your money rules. Use a budget, shared visibility, and bill priority, see how to set a gambling budget and stick to it.

- Start now. Fast action limits losses and reduces harm.

FAQ

What is a self-exclusion program?

A self-exclusion program blocks you from gambling for a set time. You sign up and agree to stay away from specific venues or licensed sites. Operators must deny access, stop marketing to you, and block your play where the program applies.

How long does self-exclusion last?

Terms vary by program. Many offer options like 6 months, 1 year, 5 years, or lifetime. Some programs lock you in until the term ends. Others allow a formal review after a minimum period. Choose the longest term you can commit to.

What gets blocked when you self-exclude?

You usually lose account access, deposits, wagering, and bonuses. Sites should block new account creation and stop promo emails and texts. In-person programs may require staff to remove you from the floor. Coverage depends on the regulator and operator network.

Will self-exclusion cover every casino and betting app?

No. Some programs cover one operator. Others cover all licensed operators in a state or country. It rarely blocks unlicensed sites. You must check the program list before you enroll. Add payment blocks and device blocks for wider coverage.

Can you cancel or shorten self-exclusion?

Many programs do not allow early cancellation. Some allow removal only after the term ends, plus a cooling-off period. If you can cancel early, treat it as a risk point. Add stronger controls before you regain access.

What happens if you try to gamble during self-exclusion?

Online play should fail at login, deposit, or bet placement. In person, staff may ask you to leave and may trespass you. Winnings may get withheld in some jurisdictions. You may still lose money on unlicensed sites, so block payments.

Will you get your money back if a site lets you gamble?

It depends on local rules and the operator. Some regulators require refunds of deposits or losses made during an exclusion breach. Others do not. Save proof. Keep emails, screenshots, and transaction logs. Then file a complaint with the regulator.

Does self-exclusion affect your credit score or background checks?

Self-exclusion does not report to credit bureaus. It can require identity checks, which stay inside the operator and regulator systems. It may show up only where venues share exclusion lists for enforcement. Ask how data gets stored and who can access it.

What information do you need to enroll?

You usually need your legal name, date of birth, address, and a government ID. Some programs take a photo to help venue staff identify you. Online programs may also confirm your email, phone, and payment methods tied to your account.

What else should you do alongside self-exclusion?

Use limits and blocks. Set deposit limits and remove credit options. Block gambling payments and install site and app blockers. Get support and track relapse triggers. Use the warning list at /signs-of-gambling-addiction-warning-signs-and-where-to-get-help.html.

Conclusion

Self-exclusion works when you treat it as a lock, not a promise. You choose the scope, you confirm your details, and the operator blocks access for the full term. You should expect delays in enforcement across brands and limits in coverage if you only exclude from one site.

Use self-exclusion with other controls. Stack tools so one slip does not reopen the door. Combine hard blocks, money limits, and support.

- Set money limits. Use deposit limits and remove credit options. Follow practical steps at Responsible Gambling Tips: Limits, Tools, and Safer Play.

- Block access. Install site and app blockers. Block gambling payments with your bank or card provider.

- Track triggers. Write down relapse cues and high-risk times. Use the warning list at Signs of Gambling Addiction: Warning Signs and Where to Get Help.

- Plan your next 24 hours. Remove gambling apps, unsubscribe from promos, and tell one person what you changed today.

Final tip. Pick one action you can finish in 10 minutes, do it now, then schedule the next step. Momentum beats intent.

-

-

- What to do next: counseling, peer support, and financial safeguards

- Practical barriers: bank gambling blocks, blocking software, app limits, device controls

- How removal or reinstatement works, if allowed

- Planning for high-risk moments: triggers, accountability, and alternative activities

- If self-exclusion isn’t enough: escalate to broader protections and professional help

-

- What is a self-exclusion program?

- How long does self-exclusion last?

- What gets blocked when you self-exclude?

- Will self-exclusion cover every casino and betting app?

- Can you cancel or shorten self-exclusion?

- What happens if you try to gamble during self-exclusion?

- Will you get your money back if a site lets you gamble?

- Does self-exclusion affect your credit score or background checks?

- What information do you need to enroll?

- What else should you do alongside self-exclusion?

-

-

-

- What to do next: counseling, peer support, and financial safeguards

- Practical barriers: bank gambling blocks, blocking software, app limits, device controls

- How removal or reinstatement works, if allowed

- Planning for high-risk moments: triggers, accountability, and alternative activities

- If self-exclusion isn’t enough: escalate to broader protections and professional help

-

- What is a self-exclusion program?

- How long does self-exclusion last?

- What gets blocked when you self-exclude?

- Will self-exclusion cover every casino and betting app?

- Can you cancel or shorten self-exclusion?

- What happens if you try to gamble during self-exclusion?

- Will you get your money back if a site lets you gamble?

- Does self-exclusion affect your credit score or background checks?

- What information do you need to enroll?

- What else should you do alongside self-exclusion?

-

-

Fairness in Casino Games: RNGs, Odds, House Edge, and Return-to-Player (RTP) - Security, Fairness, and Regulation: How Casinos Keep Games Legit - What Is a Casino and How Does It Work? A Beginner’s Guide

1 week ago -

Regulation and Licensing: Who Oversees Casinos and What Rules They Must Follow - Security, Fairness, and Regulation: How Casinos Keep Games Legit - What Is a Casino and How Does It Work? A Beginner’s Guide

1 week ago -

Security, Fairness, and Regulation: How Casinos Keep Games Legit - What Is a Casino and How Does It Work? A Beginner’s Guide

1 week ago -

What Is a Casino and How Does It Work? A Beginner’s Guide

1 week ago -

How Casinos Make Money: House Edge, RTP, and the Math Behind It

1 week ago

-

Security, Fairness, and Regulation: How Casinos Keep Games Legit - What Is a Casino and How Does It Work? A Beginner’s Guide

1 week ago -

RTP Explained: How to Use Return to Player to Choose Slots

1 week ago -

What Is a Casino and How Does It Work? A Beginner’s Guide

1 week ago -

Casino RNG Explained: How Random Number Generators Work

1 week ago -

How to Set a Gambling Budget (and Stick to It)

1 week ago